By now, it’s no surprise that certain European startups are facing difficulties and are likely charting new strategic paths for the future. Foreign investment in mature technology startups across Europe has reached a four-year low. (Acorrding to the recent report from venture capital firm Atomico). The investment in European startups nosedived to over €40 billion this year, marking a steep 55% decline from 2021. This downturn comes as investors contend with hurdles in securing funds, as highlighted in Atomico data. Or, in other cases, when startups decide to take a different approach looking forward to more sustainable growth.

Pitch

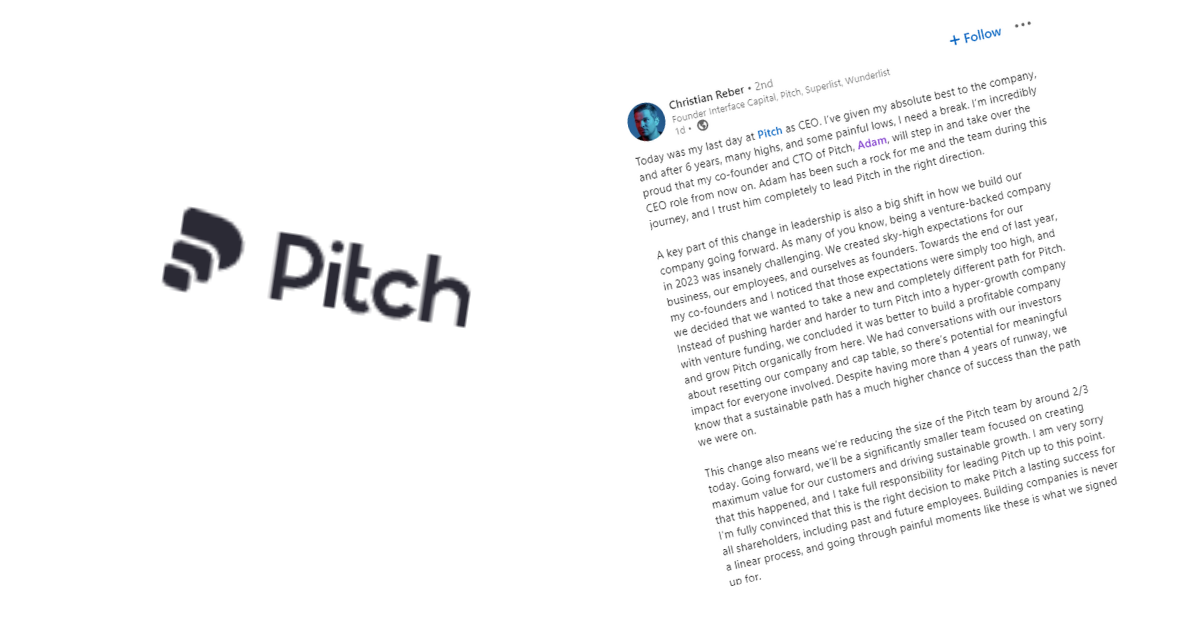

One of these examples is Pitch, a Berlin-based startup founded in 2018.

Founded in 2018, Berlin-based Pitch arrived in private beta back in 2019 with $30 million in funding. The round was led by the creators of an app called Wunderlist which Microsoft bought in 2015. Pitch had raised north of $130 million in funding from the likes of Lakestar, Index Ventures and Tiger Global Management. It was supported by a slew of high-profile angels, including the founders of Instagram and Zoom.

As with just about every other VC-backed startup, Pitch has clearly faced challenging times in terms of maintaining growth and keeping their investors happy.

As a result, its CEO, Christian Reber announced via Linkedin that he was stepping down on the 8th of January, 2024. He said in a post:

Today was my last day at Pitch as CEO. I’ve given my absolute best to the company, and after 6 years, many highs, and some painful lows, I need a break. I’m incredibly proud that my co-founder and CTO of Pitch, Adam, will step in and take over the CEO role from now on. Adam has been such a rock for me and the team during this journey, and I trust him completely to lead Pitch in the right direction.

This statement outlines a significant shift in the ecosystem: The acknowledgment of the challenges faced by venture-backed companies in 2023 and the resulting high-pressure environment that is impacting the business, employees, and founders themselves.

What this means

The decision to take a different approach for the company, specifically in transitioning from a hyper-growth model fueled by venture funding to prioritize profitability and organic growth, indicates a fundamental change in strategy. Founders are recognizing that previously set expectations were maybe overly ambitious. This is prompting startups to reconsider their goals and values for the future. The willingness to engage in conversations with investors about restructuring the company and cap table is probably healthy and suggests a commitment to alignment and cooperation among all stakeholders.

Parties’ efforts aim for a more equitable and mutually beneficial outcome. Despite having a substantial runway, Reber acknowledged that pursuing a sustainable path offers a greater likelihood of long-term success compared to their prior trajectory.

—

Are you looking for your next tech hire? Get in touch with one of the PL Talents’ experts – we are the number one tech recruitment specialist in Germany.